PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

वैश्विक बाजारों को अपने हाथों में करें

हमारा ट्रेडिंग मोबाइल ऐप ज़्यादातर स्मार्ट डिवाइसिस पर काम करता है। अभी ऐप डाउनलोड करेंऔर PU Prime के साथ किसी भी डिवाइस पर, कभी भी और कहीं भी ट्रेडिंग शुरू करें।

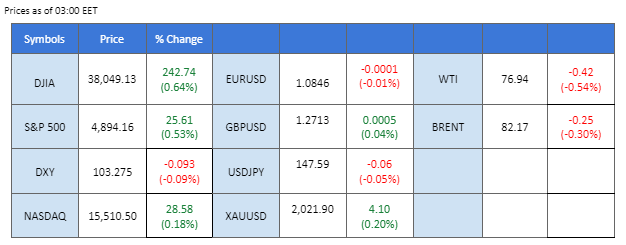

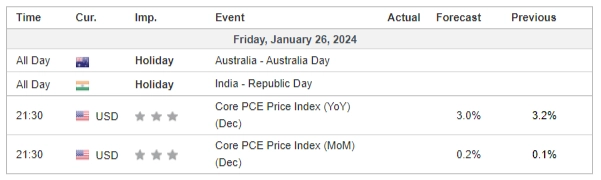

The U.S. equity markets continue to surge, propelled by a rally in tech stocks, notably led by Nvidia—the world’s largest chip maker. Optimistic earnings outlooks from Nvidia suggest that the industry is outperforming expectations. Concurrently, robust recent economic data from the U.S. is providing support for the dollar, holding it above the $103 mark, with anticipation building around the forthcoming U.S. PCE reading scheduled for later today. On the monetary policy front, the European Central Bank (ECB) has opted to maintain its interest rates at levels in line with market expectations. The ECB’s chair has explicitly ruled out a near-term rate cut, emphasizing the importance of sustaining current interest rates to manage consumer prices effectively. In the energy markets, oil prices have witnessed their most significant rally since last October. This impressive surge can be attributed to a confluence of factors, including geopolitical uncertainties in the Red Sea, a drawdown in U.S. stockpiles, and the recent stimulus measures introduced by the Chinese government.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

(MT4 System Time)

Source: MQL5

The Dollar Index, tracking against a basket of major currencies, maintains its bullish momentum following the release of robust US GDP data. The Bureau of Labor Statistics reports a significant 3.3% growth in the last quarter, surpassing market expectations of 2.0%. Despite the optimism, the Dollar’s gains face limitations due to a less-than-rosy jobs report, with US Initial Jobless Claims exceeding market expectations at 214K.

The Dollar Index is trading higher following prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 103.95, 104.70

Support level: 103.20, 102.30

As the US Dollar strengthens post-impressive GDP figures, gold prices face a bearish tilt. However, uncertainties loom as a critical inflation report is set to be released. Global investors are closely eyeing the upcoming US Fed-gauge inflation report, the Core PCE Index, to assess potential movements in the gold market.

Gold prices are trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2035.00, 2055.00

Support level: 2019.00, 1985.00

GBP/USD has witnessed two consecutive sessions of losses against the dollar. The positive U.S. Gross Domestic Product (GDP) data bolstered the dollar’s strength. However, this was somewhat tempered by a significant increase in Initial Jobless Claims, indicating a potential softening in the U.S. job market. Market participants are now closely watching the U.S. Personal Consumption Expenditures (PCE) reading to glean insights into the Federal Reserve’s potential upcoming monetary policy moves.

GBPUSD is trading in a downtrend trajectory and faced a strong resistance level at 1.2785 level. The RSI flowing flat while the MACD has declined to near the zero line from above suggests the previous bullish momentum has vanished.

Resistance level: 1.2785, 1.2815

Support level: 1.2710, 1.2610

The Euro retraces its steps after the European Central Bank (ECB) maintains its key rate at a record 4%. Despite ECB chief Christine Lagarde emphasising the premature nature of rate cut discussions, scepticism lingers among investors. Economic indicators, including EU zone inflation and wages, suggest signs of decline. The interest-rate sensitive two-year Euro bond yields drop sharply, signalling heightened expectations for an ECB rate cut in April.

The EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.0925, 1.1005

Support level: 1.0830, 1.0745

The Australian dollar is presently trading above a pivotal liquidity zone and shows potential for a breakthrough at its immediate resistance level at 0.6617. This strength in the Australian dollar is attributed to the positive impact of China’s recent economic stimulus package. Remarkably, the Australian dollar is holding its ground despite the U.S. dollar gaining strength, propelled by encouraging economic data. Market focus is now directed towards today’s U.S. Personal Consumption Expenditures (PCE) reading, which is anticipated to provide insights into the dollar’s strength. The implications of this data release on the AUD/USD pair will be closely monitored by investors and traders alike.

The AUD/USD pair is currently trading above its liquidity zone, suggesting a potential trend reversal for the pair. The RSI remains flat, while the MACD flowing closely to the zero line suggests a neutral signal for the pair.

Resistance level: 0.6617, 0.6712

Support level: 0.6520, 0.6400

The Japanese Yen was boosted following the hawkish tone observed in the Bank of Japan (BoJ) meeting minutes. These minutes suggest that the Japanese central bank is gearing up for a potential exit from negative interest rates, signalling an inclination to pull short-term interest rates out of negative territory. However, the U.S. dollar continues to exhibit strength, propelled by positive economic data from the United States. Traders are keenly observing the forthcoming release of the U.S. Personal Consumption Expenditures (PCE) data later today. This data is expected to provide insights into the potential movements of the USD/JPY pair and could significantly shape market sentiment.

The pair is currently trading at above its crucial liquidity zone, suggesting a bullish bias for the pair. The RSI has declined to near the 50 levels while the MACD has dropped to the zero line from above, suggesting the bullish momentum has drastically eased.

Resistance level: 148.67, 151.76

Support level: 146.76, 145.21

Oil prices surge to their highest levels since December, fueled by positive signs of economic recovery in 2024 and disruptions in the Red Sea impacting global trade. Chinese authorities’ multi-billion-dollar stimulus plan and robust US economic growth contribute to positive prospects for oil demand. Geopolitical tensions in the Middle East and ongoing disruptions in the Red Sea continue to pose threats to oil supply.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 75, suggesting the commodity might enter overbought territory.

Resistance level: 78.65, 80.00

Support level: 75.25, 70.25

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

हमारी आसान प्रक्रिया के साथ PU Prime लाइव अकाउंट के लिए साइन अप करें

कई सारे चैनल्स और स्वीकृत करेंसियों के साथ आसानी से अपने अकाउंट में फंड्स डिपॉजिट करें

बाज़ार-अग्रणी व्यापारिक परिस्थितियों में सैकड़ों इंस्ट्रूमेंट्स तक पहुंच प्राप्त करें

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!