-

- व्यापार शर्तें

- खाता प्रकार

- स्प्रेड्स, लागत और स्वैप

- जमा और निकासी

- शुल्क और शुल्क

- व्यापार घंटे

-

- कॉर्पोरेट

- विनियमन

- कानूनी दस्तावेज़

- मुआवजा कोष

- ग्राहक धन बीमा

- ESG

Content:

Risk management lies at the core of successful trading. It is the process of identifying, assessing, and mitigating potential risks that could impact your trading activities and financial outcomes. Risk management in trading encompasses various strategies and techniques aimed at preserving capital, reducing exposure to market fluctuations, and optimising returns. By understanding and implementing effective risk management practices, traders can navigate the inherent uncertainties of the financial markets with greater confidence and control.

In this article, we will delve into the various kinds of risks one can be exposed to when trading the financial markets, and explore various ways to minimise and manage these risks in order to increase the probability of a favourable trading outcome.

Assessing and identifying risks in trading is crucial for effective risk management in trading and safeguarding trading capital. Traders must remain vigilant in evaluating various types of risks that can impact their trading activities. There are many types of risk to consider when trading, each with unique considerations that need to be addressed, here are some of the most common to CFD traders.

Perhaps the most common kind of risk considered by traders. Market risk refers to the potential for losses due to changes in market prices or factors that affect the overall market. It includes the risk of adverse price movements in stocks, bonds, commodities, currencies, or other financial instruments. Market risk can result from factors such as economic events, geopolitical developments, interest rate changes, or supply and demand imbalances. All these can cause volatility in the markets, and might result in outsized losses if not properly managed.

As an active trader, it is important to conduct thorough market research and stay informed about relevant news and trends. For example, one common way traders do this is by keeping track of when important economic or financial data is released. In the case of trading currencies, traders will look closely at what is called an economic calendar, which shows when macroeconomic data will be released by various countries.

Another example of a data release is the earnings dates for listed companies. These are dates every quarter when companies publish details about their revenue, expenses, profitability, and other key financial metrics.

The publishing of earnings and macroeconomic data both induce considerable volatility on their related assets, which will call for tighter risk management measures.

Market risk can also arise from systemic issues or failures – like bank collapses or recessions, which can cause extremely volatile movement as fear starts to creep into the markets. It is important to be aware of impending situations like these, and trade them carefully.

Liquidity risk refers to the risk of being unable to buy or sell an asset quickly and at the desired price. It occurs when there is insufficient trading volume or market depth for a particular security or instrument. Illiquid markets can result in slippage, where the executed price differs from the expected price, potentially leading to losses or challenges in exiting positions.

There are various ways to mitigate liquidity risk. The most straightforward way will be to trade instruments with a high trading volume, such as major currency pairs like EUR/USD, or gold. Another way is to trade during more liquid periods, like when Wall Street is open or, in the case of currencies, at the time period when the New York and London markets intersect.

Liquidity risks can also arise operationally, like if your broker does not have access to sufficient liquidity or cannot rout your order fast enough. This can be mitigated by trading with an established broker like PU Prime, which has close relationships with tier-1 liquidity providers like major banks.

Operational Risk: Operational risk encompasses the risk of losses resulting from inadequate or failed internal processes, people, systems, or external events. It includes risks related to trade execution, settlement, technological failures, compliance, fraud, and human errors. For traders, this can extend to technological failures on the broker’s end like a server disruption or slow execution. On the user end, this can be everything from an internet outage to human error (it happens!) like inputting the wrong order price.

Operational risks are the hardest to see coming, but can be minimised through simple steps like picking an established broker, making sure you trade with a stable internet connection, or even trading only when you are mentally alert.

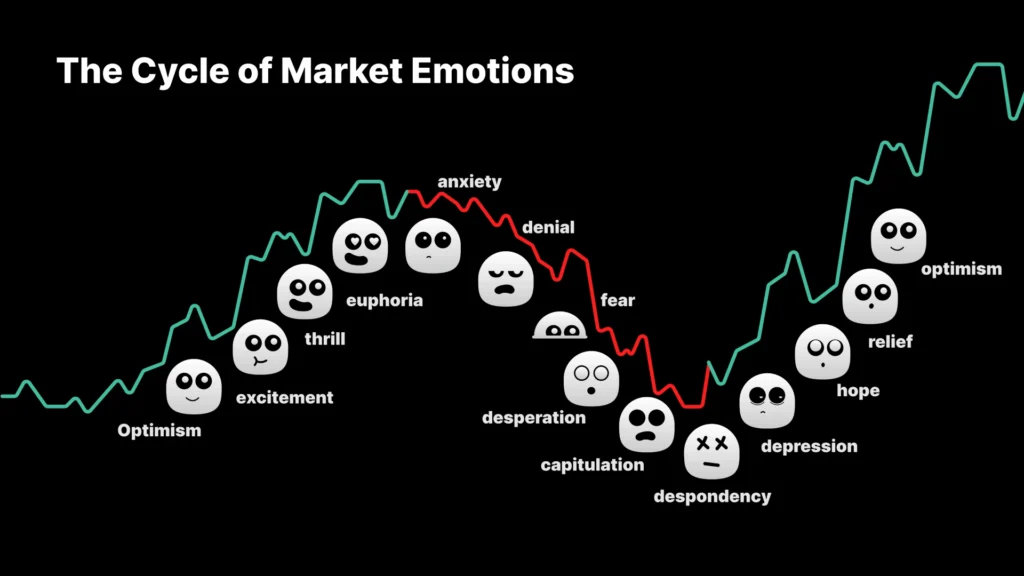

This kind of risk arises from individual traders themselves, and are often psychological in nature. Psychological risks in trading refer to the emotional and cognitive challenges that traders face, which can impact their decision-making, trading performance, and overall well-being. These risks arise from the psychological biases, pressures, and emotions that traders experience during the trading process.

Personal risks can also arise from the individual circumstances of a trader, including factors like personal finances, time availability, and even cognitive limitations. It’s important to remember that money is not the only resource used for trading – and understanding this can help traders make optimal trading decisions more often.

Of all the kinds of risks, personal risks are the ones traders have the most control over – which is why understanding the psychology of trading not only helps traders understand their own decisions, but provides invaluable insight into market movements.

Managing emotional biases is crucial for traders to optimise risk management and trading psychology in order to make objective and well-informed trading decisions. The ability to control emotions is key, as emotional biases, such as fear, greed, and overconfidence, can cloud judgement and lead to impulsive actions that deviate from a well-thought-out trading plan. Recognizing and effectively managing these biases is essential for maintaining discipline and achieving long-term trading success. Here are some tips to do so:

Maintaining discipline is a fundamental aspect of managing emotional biases in trading. Traders should adhere to their trading plan, which includes predefined entry and exit points, position sizing, and risk management strategies. By following a disciplined approach, traders can mitigate the influence of impulsive emotional responses and stay focused on their predetermined trading objectives. Implementing risk management techniques, such as setting stop loss orders and adhering to predetermined risk limits, helps to protect against excessive losses and maintain a disciplined mindset.

Using a trading journal is a powerful tool for managing emotional biases. By diligently documenting trades, including the rationale behind each decision and the emotions experienced during the process, traders can gain valuable insights into their behavioural patterns. Regularly reviewing the trading journal helps identify recurring emotional biases and provides an opportunity for self-reflection and improvement. It allows traders to objectively analyse their decisions and identify patterns of emotional responses, enabling them to make adjustments for more informed future trading.

Seeking an external perspective can offer valuable insights and help counteract emotional biases. Engaging with a trading mentor, joining trading communities, or participating in forums allows traders to share experiences and gain different perspectives. Obtaining feedback from others who have experience in the trading field can provide a fresh outlook on trading decisions and help mitigate the influence of individual emotional biases. However, it is also important to keep in mind that trading communities can result in groupthink and peer pressure that can have negative consequences for trading. Therefore, it is important to keep a clear and objective mind.

In addition to external strategies, practising mindfulness and self-awareness techniques can aid in managing emotions and promoting emotional control. This includes techniques such as deep breathing exercises, meditation, and visualisation. Developing self-awareness allows traders to recognize and acknowledge their emotions without allowing them to dictate their trading decisions. By staying present in the moment and focusing on the task at hand, traders can reduce impulsive reactions and make more rational and objective trading choices.

In conclusion, managing emotional biases is vital for optimising risk management in trading and trading psychology. By recognizing the impact of emotional biases on decision-making and employing techniques such as maintaining discipline, using a trading journal for emotional awareness, seeking external perspectives, and practising mindfulness, traders can enhance their emotional control.

Setting trading goals and determining risk tolerance are crucial steps in achieving success in the financial markets. By aligning personal risk tolerance with trading strategies and objectives, traders can effectively manage their risk exposure and make informed decisions.

Determining individual risk tolerance is essential for traders to assess the level of risk they are comfortable taking on in their trading activities. Evaluating factors such as financial situation, emotional temperament, and personal preferences helps traders understand their risk tolerance. This self-assessment ensures that traders avoid overexposure to risks that may cause excessive stress or compromise their ability to make rational decisions.

Once risk tolerance is established, aligning it with trading strategies and objectives becomes crucial. Conservative traders may focus on lower-risk strategies with consistent gains, while more aggressive traders may be comfortable taking on higher levels of risk in pursuit of potentially larger profits while being mentally prepared to undertake larger losses without letting their emotions get the better of them.

Setting realistic trading goals is another important aspect of risk management in trading. Goals should be specific, measurable, and time-bound to provide a clear sense of direction and enable proper tracking of progress. By setting realistic goals, traders avoid unrealistic expectations that may lead to impulsive decision-making or frustration during periods of market volatility.

To effectively manage trading risk and achieve trading goals, traders must continuously monitor and reassess their risk tolerance. As market conditions and personal circumstances may change, it is important to periodically review and adjust risk tolerance and goals accordingly. Regular self-reflection and evaluation help traders stay aligned with their risk management strategies and adapt to evolving market dynamics.

Find Out What You Need To Know About CFD Trading

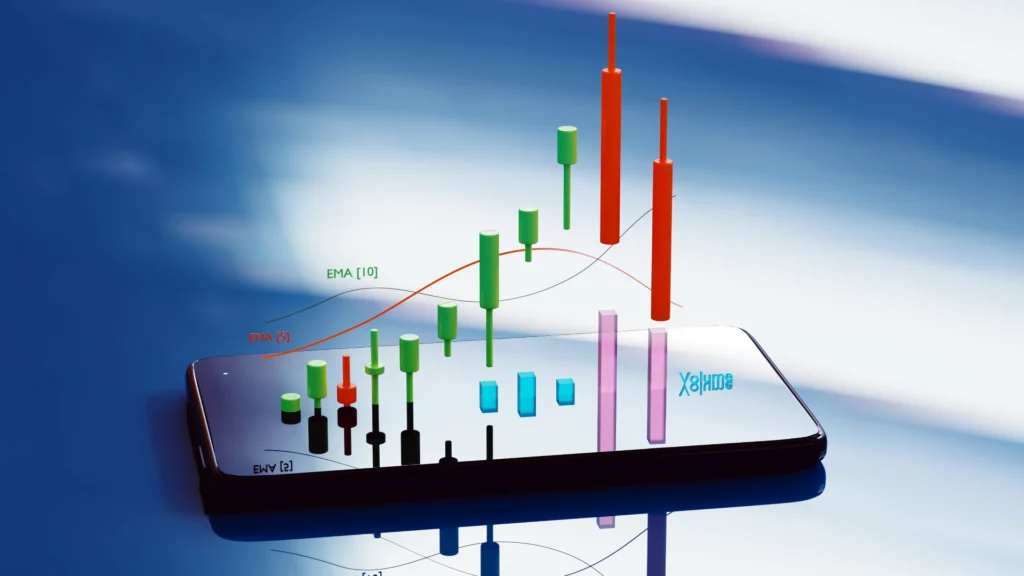

One of the most actionable ways to begin risk management is with order types. These are tools provided by your broker platform that will trigger the opening and closing of positions under certain predetermined conditions. Here are some order types to know:

A stop loss order is placed to automatically close a trade when the price reaches a specific level that indicates an unacceptable loss. It acts as a safety net, protecting traders from significant downside risks. By setting a stop loss order, traders establish a maximum loss they are willing to tolerate for each trade. This ensures that losses are limited, allowing traders to preserve their trading capital and maintain overall portfolio stability.

A take profit order is set to automatically close a trade when the price reaches a predetermined level that indicates a satisfactory profit. It allows traders to secure gains by exiting a trade once the desired profit target is reached. By setting a take profit order, traders lock in profits and avoid the temptation to hold onto positions for too long, potentially risking a reversal in market conditions.

A market order is an instruction to buy or sell a security at the current market price. It is executed immediately, ensuring a fast execution but without guaranteeing the exact price at which the order will be filled. Market orders prioritize speed of execution over price.

A limit order is an instruction to open a position at a specific price or better. A buy limit order specifies the maximum price the buyer is willing to pay, while a sell limit order specifies the minimum price the seller is willing to accept. Limit orders provide price control but there is a risk that the order is not filled in time if the specified price is not available in the market.

A stop order is an instruction to open a position when it reaches a specified price level, known as the stop price. A sell stop order is triggered when the market price falls to or below the stop price, while a buy stop order is triggered when the market price rises to or above the stop price. While a stop order guarantees execution, the price of execution might not be at the desired level.

A trailing stop order is a dynamic order type that allows traders to set a stop price that follows the market price at a certain distance. If the market price moves in a favorable direction, the trailing stop price adjusts accordingly, maintaining the specified distance. Trailing stop orders are used to lock in profits while allowing for potential further gains if the market continues to move favorably.

To effectively implement stop loss and take profit orders, traders should consider the following guidance:

Stop loss (SL) and take profit (TP) levels should be determined based on thorough analysis and consideration of market conditions, volatility, and individual risk tolerance. Traders should avoid setting levels too close to the entry price, which may result in premature exits, or too far away, which may expose them to excessive risk. SL and TP levels are usually put at or around resistance and support levels determined through technical analysis, the methods of which can be found here.

Volatile markets may require wider stop loss levels to accommodate price fluctuations, while less volatile markets may allow for tighter levels. Adapting stop loss and take profit levels to market conditions helps strike a balance between risk and reward.

Stop loss and take profit orders should be an integral part of a well-defined trading plan. Traders should consistently apply these orders to ensure disciplined and consistent risk management.

Traders should periodically review and adjust stop loss and take profit levels as market conditions evolve. This includes trailing stop loss orders, where the stop loss level is adjusted to trail behind favourable price movements, locking in profits along the way.

Beyond order types, other ways to manage risk include position sizing, risk-reward ratio, trailing stops, and diversification.

Position sizing is a fundamental risk management tool that involves determining the appropriate size of each trade based on trading capital and risk tolerance. By allocating a predetermined percentage of their capital to each trade, traders can limit potential losses and maintain consistent risk exposure. Proper position sizing helps protect the trading account from significant drawdowns and enables better risk diversification.

The risk-reward ratio is another valuable tool that allows traders to assess the potential profitability of a trade relative to the amount of risk taken. It involves comparing the potential reward, typically the profit target, with the potential risk, usually the stop loss level. Seeking trades with a favourable risk-reward ratio, such as a higher potential reward compared to the potential risk, can lead to positive expectancy over the long run. A positive risk-reward ratio enables traders to achieve profits even with more losing trades than winning ones.

Diversification is a risk management strategy that involves spreading risk across different markets, instruments, or asset classes. By diversifying their trades, traders reduce the impact of any single trade or market event. Diversification helps to mitigate the risk of concentrated exposure and can potentially enhance overall portfolio performance.

Understand How Asset Classes Correlate With One Another

Monitoring and evaluating risk management strategies on an ongoing basis is vital for traders to stay ahead of market dynamics and maintain effective risk mitigation. The financial markets are dynamic and subject to constant changes, making it imperative for traders to adapt their risk management strategies accordingly.

Regularly monitoring risk management strategies allows traders to identify potential weaknesses or areas for improvement. It provides an opportunity to review past trades, assess risk exposures, and evaluate the effectiveness of risk mitigation techniques employed. By analysing performance metrics, such as win-loss ratios, drawdowns, and risk-adjusted returns, traders can gain insights into the strengths and weaknesses of their risk management strategies.

One key factor to consider when monitoring risk management strategies is market conditions. Different market environments can require adjustments in risk management approaches. For example, during periods of heightened volatility, traders may need to widen stop loss levels or reduce position sizes to account for increased price fluctuations. In contrast, during periods of low volatility, tighter risk parameters may be appropriate.

Monitoring risk management strategies also involves evaluating the impact of external factors, such as economic news releases, geopolitical events, or changes in regulatory policies. These events can significantly impact market dynamics and require adjustments to risk management strategies. By staying informed and adapting strategies in response to such events, traders can mitigate potential risks and capitalise on opportunities.

Identifying when adjustments are necessary requires a combination of self-reflection, objective analysis, and staying attuned to market conditions. Some key indicators that adjustments may be needed include consistently poor trading performance, significant changes in market volatility, or a series of unexpected losses. Traders should also pay attention to feedback from their trading journal and seek external perspectives through engaging with mentors or trading communities.

When adjustments are deemed necessary, traders should approach them with a systematic and disciplined mindset. This involves analysing the root causes of underperformance or excessive risk exposure and identifying specific areas for improvement. Adjustments may include modifying position sizing, refining stop loss and take profit levels, or incorporating new risk management techniques based on lessons learned from past trades.

Margin trading allows traders to control larger positions in the market with a relatively smaller amount of capital. It offers the potential for higher returns by leveraging borrowed funds from a broker. By using leverage, traders can amplify their trading positions and potentially generate larger profits than would be possible with their available capital alone.

However, it is important to note that margin trading comes with inherent risks. While leverage can amplify potential profits, it can also magnify losses. This leads us to the stop-out, which is a condition set by most brokers offering trading on leverage. The stop-out level is usually defined as a certain margin level percentage. When the margin level hits the stop-out level, it indicates that the trader’s account lacks sufficient equity to maintain the open positions and their broker will begin to close out positions until the margin level is restored above the stop-out level. This is often referred to as a margin call or margin closeout.

Short-term trading, often known as day trading or scalping, involves opening and closing positions within a relatively short time frame, usually within a day or even minutes. Long-term trading, on the other hand, refers to holding positions for extended periods, ranging from weeks to months or even years. Both styles require effective risk management strategies, but the approaches differ due to the varying time horizons and trading dynamics involved.

In short-term trading, the rapid pace of trades and the focus on capturing small price movements require traders to be highly disciplined and nimble. Risk management in short-term trading revolves around tight stop loss levels and quick decision-making. Traders must be prepared to cut losses swiftly when trades move against them, as small losses can quickly accumulate if not managed promptly. Position sizing is also critical in short-term trading to ensure that no single trade has a significant impact on the overall trading capital.

Risk management in trading in the long term focuses more on capital preservation and riding out market fluctuations. The extended time horizon allows for a more patient approach to managing trading risk. Long-term traders often employ wider stop loss levels to accommodate market volatility and give their positions room to breathe. Position sizing in long-term trading may be based on a percentage of the overall trading capital or the risk tolerance of the trader.

Long-term traders face the challenge of staying committed to their positions despite short-term market fluctuations. They need to have a thorough understanding of the fundamentals driving the markets they are trading and exercise patience and discipline to allow their positions to unfold over time.

Adapting risk management strategies in short-term and long-term trading involves considering the specific challenges of each style and tailoring the approach accordingly. Short-term traders should focus on precise entry and exit points, employ tight stop loss levels, and actively manage their positions throughout the trading day. Long-term traders, on the other hand, should emphasise comprehensive market analysis, employ wider stop loss levels to account for volatility, and practise patience in allowing their trades to reach their intended targets.

Regardless of the trading style, risk management in both short-term and long-term trading should include the use of appropriate risk-reward ratios, regular monitoring of trades, and ongoing assessment of performance metrics. Traders should also continuously educate themselves on risk management techniques and market dynamics to stay ahead of potential risks.

In conclusion, the evolution of risk management in the trading industry reflects the ongoing quest to enhance risk mitigation strategies. Advancements in technology, lessons learned from past market events, and emerging trends have shaped risk management practices over time. From personal judgement to quantitative models and advanced analytics, risk management continues to evolve to meet the demands of a rapidly changing trading landscape.

Start Trading CFD By Signing Up With PU Prime’s Live/Demo Account

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

हमारी आसान प्रक्रिया के साथ PU Prime लाइव अकाउंट के लिए साइन अप करें

कई सारे चैनल्स और स्वीकृत करेंसियों के साथ आसानी से अपने अकाउंट में फंड्स डिपॉजिट करें

बाज़ार-अग्रणी व्यापारिक परिस्थितियों में सैकड़ों इंस्ट्रूमेंट्स तक पहुंच प्राप्त करें

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!